The world’s largest EV battery maker warned that it expects to report much less income in 2024 than the earlier 12 months, sending share costs down on Wednesday. CATL (SHE: 300750) inventory dipped after its 2024 Annual Efficiency Forecast was launched. Right here’s a preview of CATL’s financials for final 12 months.

CATL inventory falls on decrease 2024 income expectations

CATL launched the forecast in a submitting with the Shenzen Inventory Trade late Tuesday, previewing its full-year 2024 financials.

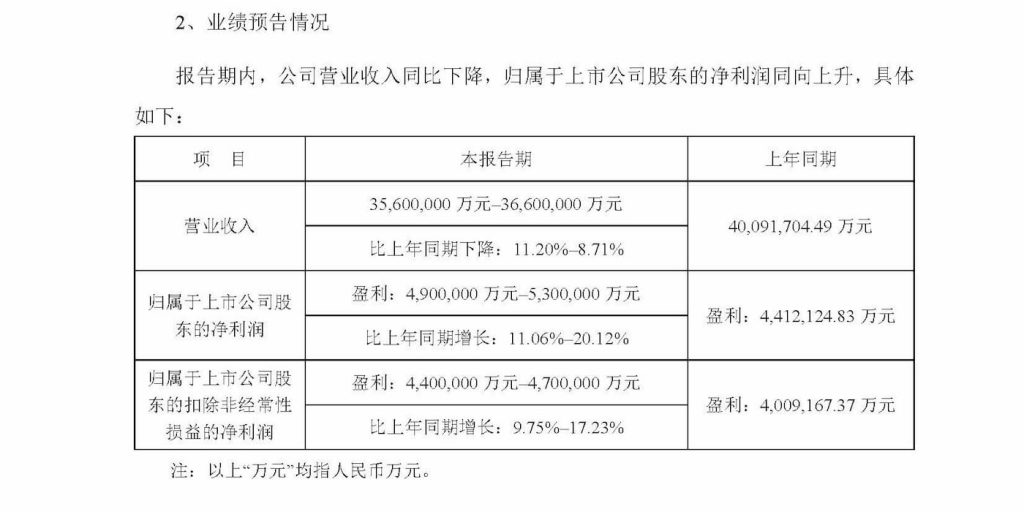

The battery big expects annual income of between RMB 356 billion ($48.9 billion) and RMB 366 billion ($50.3 billion), suggesting an 11.20% to eight.71% lower from 2023. This is able to mark CATL’s first time reporting decrease annual income than the 12 months earlier than.

CATL stated that though gross sales quantity was up, the decrease expectations have been as a consequence of falling uncooked materials costs, together with lithium carbonate. Regardless of this, the corporate nonetheless expects to publish annual web revenue of RMB 49 billion ($6.7 billion) to RMB 53 billion ($7.3 billion), which might be up 11.06% to twenty.12% from 2023.

Excluding non-recurring features and losses, CATL expects web revenue attributable to shareholders between RMB 44 billion ($6 billion) and RMB 47 billion ($6.5 billion), up 9.75% to 17.23% from 2023.

CATL stated the upper web earnings have been “primarily as a result of firm’s technological analysis and growth capabilities.” It additionally stated the competitiveness of its merchandise continues to extend.

After launching a sequence of recent merchandise and know-how whereas increasing its partnerships final 12 months, CATL expects “regular development” in efficiency.

Simply yesterday, a neighborhood report from Jieman claimed CATL anticipated to announce plans for yet one more EV battery plant in Europe because it expands its international attain. The brand new facility could be along with the one revealed final month with Stellantis and CATL’s fourth in Europe.

In keeping with SNE Analysis, CATL remained the world’s largest EV battery maker, commanding 36.8% of the worldwide market by means of the primary 11 months of 2024.

CATL launched its new Bedrock Chassis final month, which it calls “the world’s first ultra-safe” EV skateboard chassis. It’s additionally aggressively increasing its EV battery swap plans with a brand new line of Choco-SEB batteries, which make swapping even faster than filling a fuel tank (inside 100 seconds).

Regardless of the arrogance and better web earnings, CATL’s inventory slipped round 2% on Wednesday following the decrease income expectations.

CATL shares are nonetheless up practically 70% over the previous 12 months, because the EV battery chief launched new merchandise and expanded its international market lead.

FTC: We use revenue incomes auto affiliate hyperlinks. Extra.