Lucid Motors, VinFast, Rivian, and a number of other different electrical car (EV) makers are more likely to see their gross sales drop if President-elect Donald Trump follows via on guarantees to overturn the $7,500 federal tax credit score on EV purchases, particularly since many firms are having access to the credit score via a particular leasing loophole.

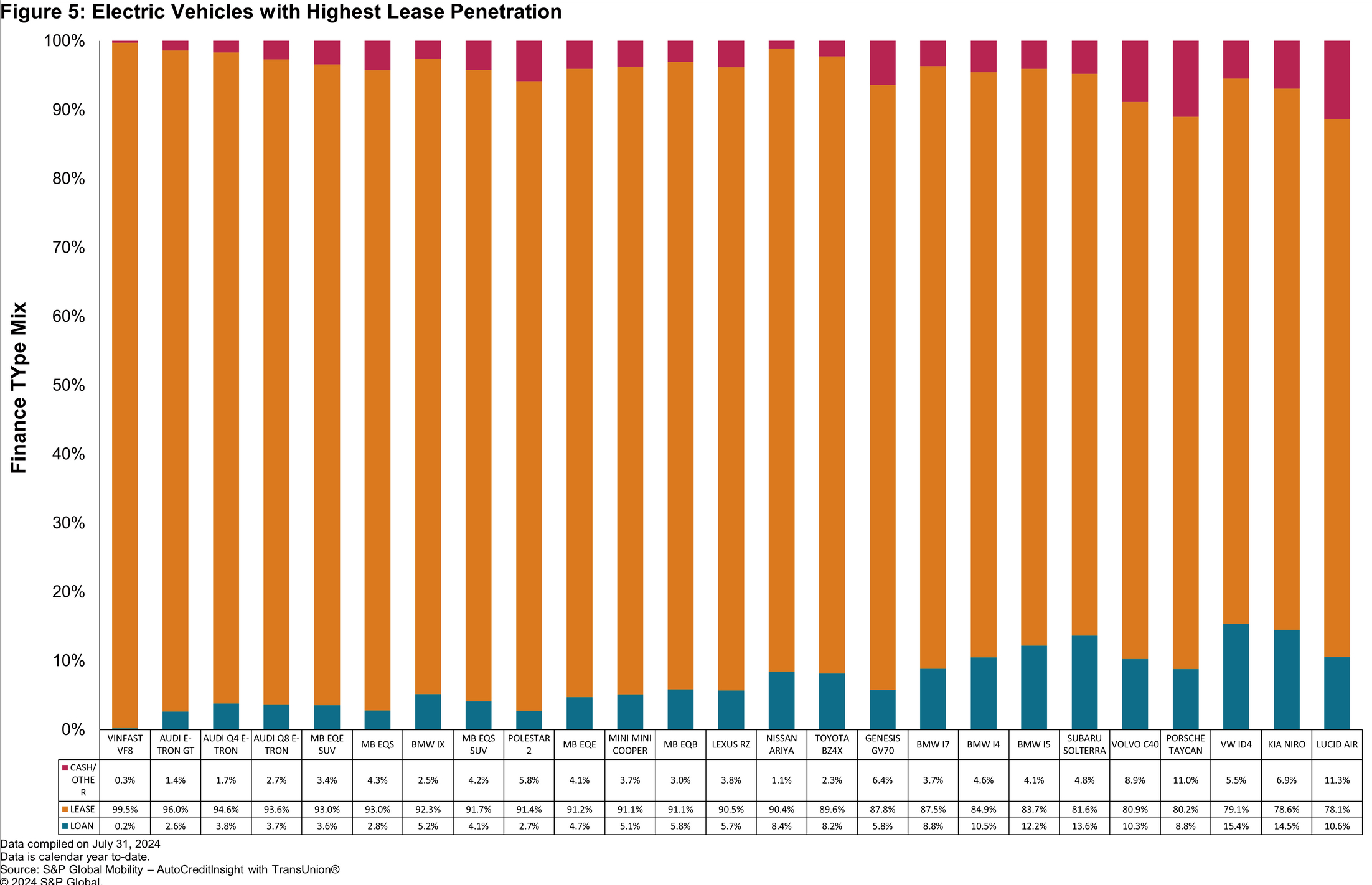

Based on experiences from S&P International Mobility in August, the Lucid Air had a leasing charge of 78.1 p.c as of the tip of July, whereas the VinFast VF8 was leased 99.5 p.c of the time. Different fashions such because the Polestar 2, Nissan Ariya, and the Volkswagen ID.4 had leasing charges of 91.4 p.c, 90.4 p.c, and 79.1 p.c, respectively.

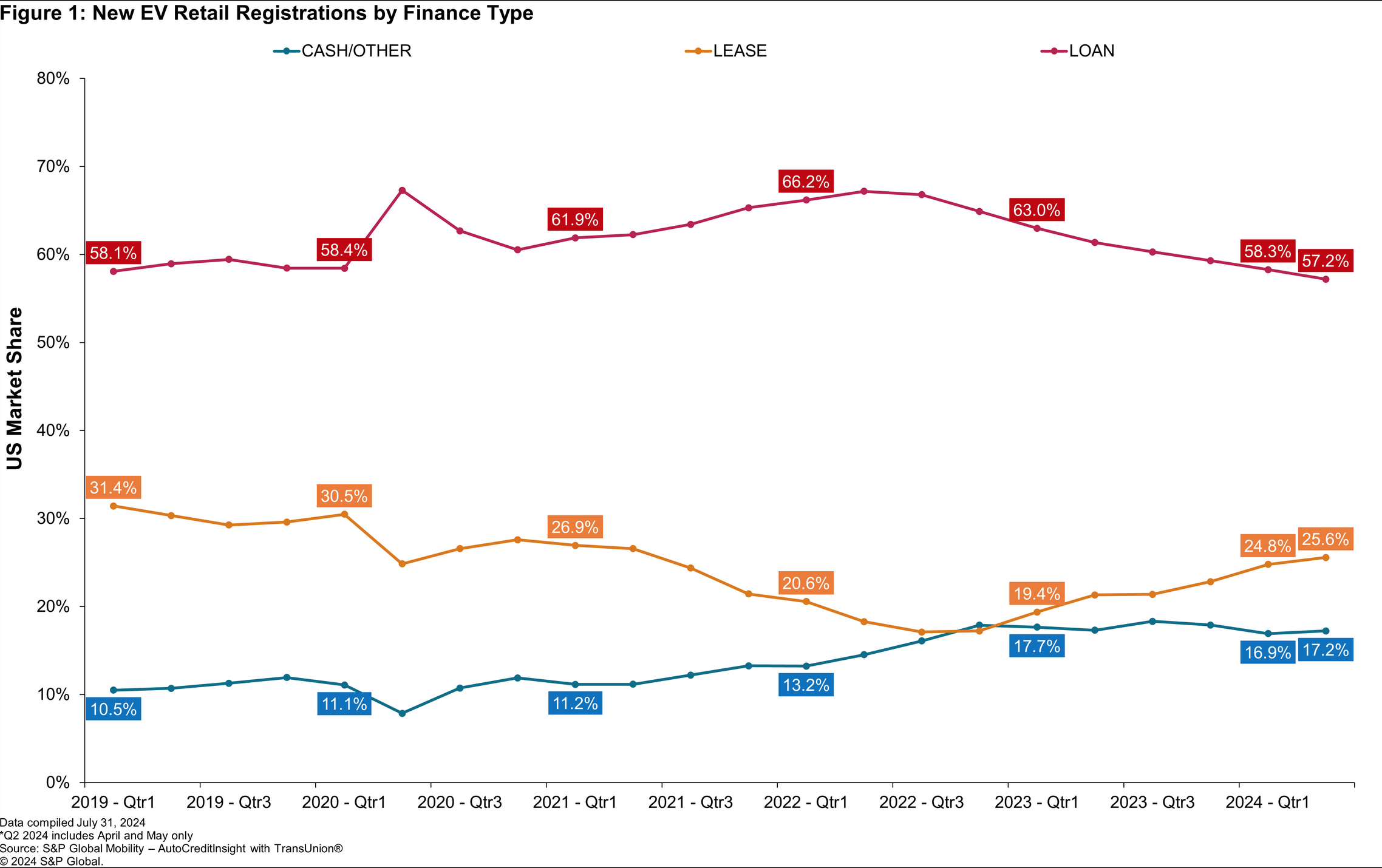

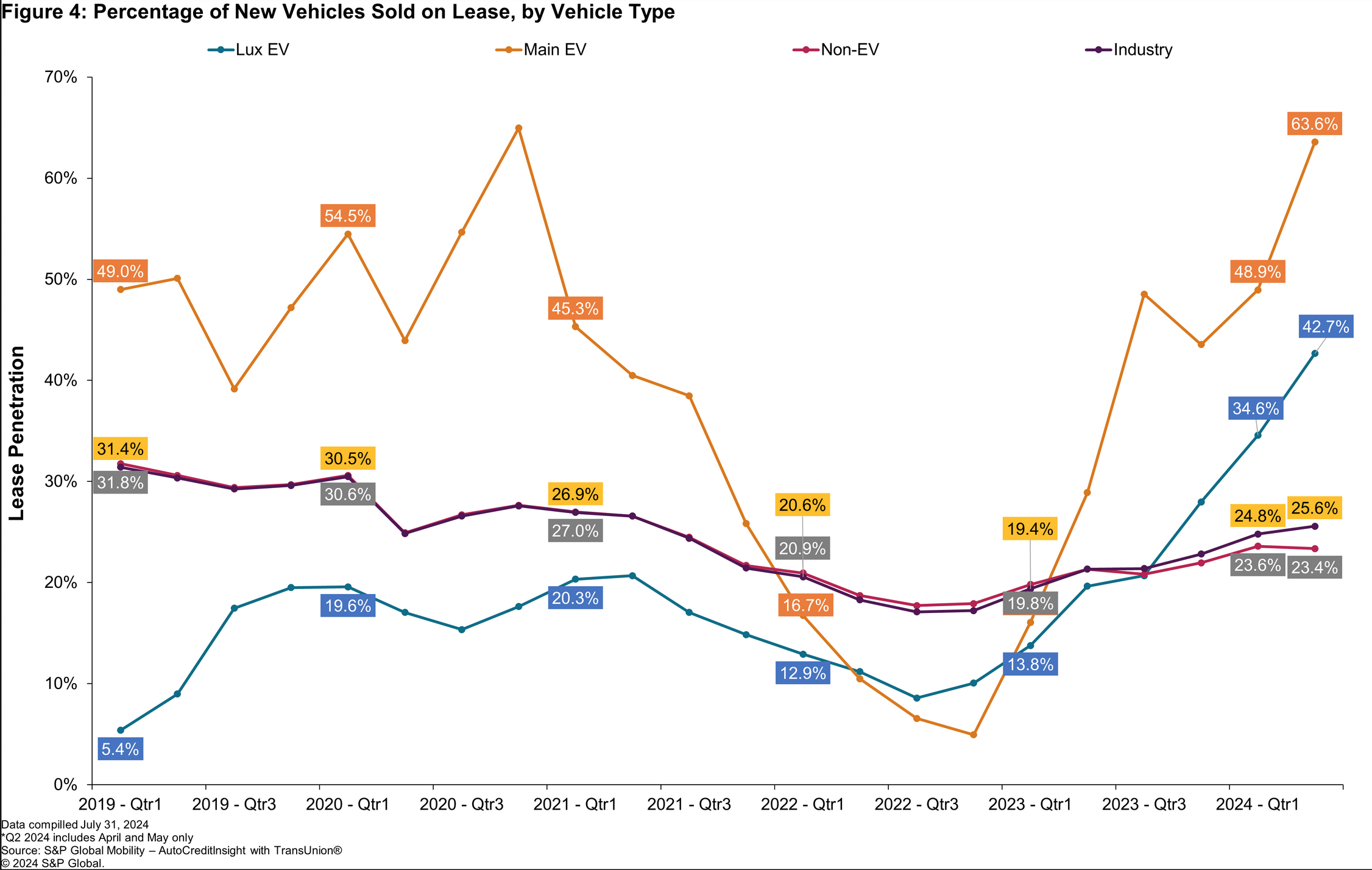

Throughout the trade in each the posh and mainstream segments—and throughout legacy and EV startups alike—EV leasing ranges have elevated considerably over the previous few years, particularly as the choice has allowed legacy automakers and EV startups alike to entry a loophole, making their autos eligible for the $7,500 tax credit score. These leases successfully let the automaker obtain the tax credit score, slightly than the buyer, earlier than it’s handed onto consumers via specialised, low-monthly-payment leasing agreements. Most direct-to-consumer automakers additionally issue the credit score into buy costs via their web site.

Credit score: S&P International Mobility

Credit score: S&P International Mobility

Credit score: S&P International Mobility

S&P International Mobility additionally pointed to the significance of manufacturers being “aggressive gamers” within the leasing enterprise to garner aggressive EV gross sales, whereas it additionally notes that authorities rules at each the state and federal ranges may have a big affect in the marketplace. As of final month, the point-of-sale EV credit had surpassed $2 billion, representing purchases from greater than 300,000 consumers.

Whereas Trump’s potential repeal of the tax credit score and different EV incentives might come as a detriment to the vast majority of EV makers, nevertheless, Elon Musk has usually highlighted how such a transfer may really stand to profit Tesla.

“As for Tesla, take a minute to learn our public filings and you will note that EV incentives symbolize a minor a part of our income. However, oil & fuel firms get huge tax breaks that exceed these given to the EV trade by a number of orders of magnitude,” Musk wrote in a publish on X in September, responding to critiques of Trump’s potential removing of the federal incentive.

What are your ideas? Let me know at [email protected], discover me on X at @zacharyvisconti, or ship us suggestions at [email protected].